Darsazma News Hub

Your go-to source for the latest news and insightful information.

Crypto Market Volatility: Riding the Rollercoaster of Digital Assets

Experience the thrilling highs and lows of crypto market volatility. Discover tips to navigate the wild ride of digital assets!

Understanding the Causes of Crypto Market Volatility: Key Factors at Play

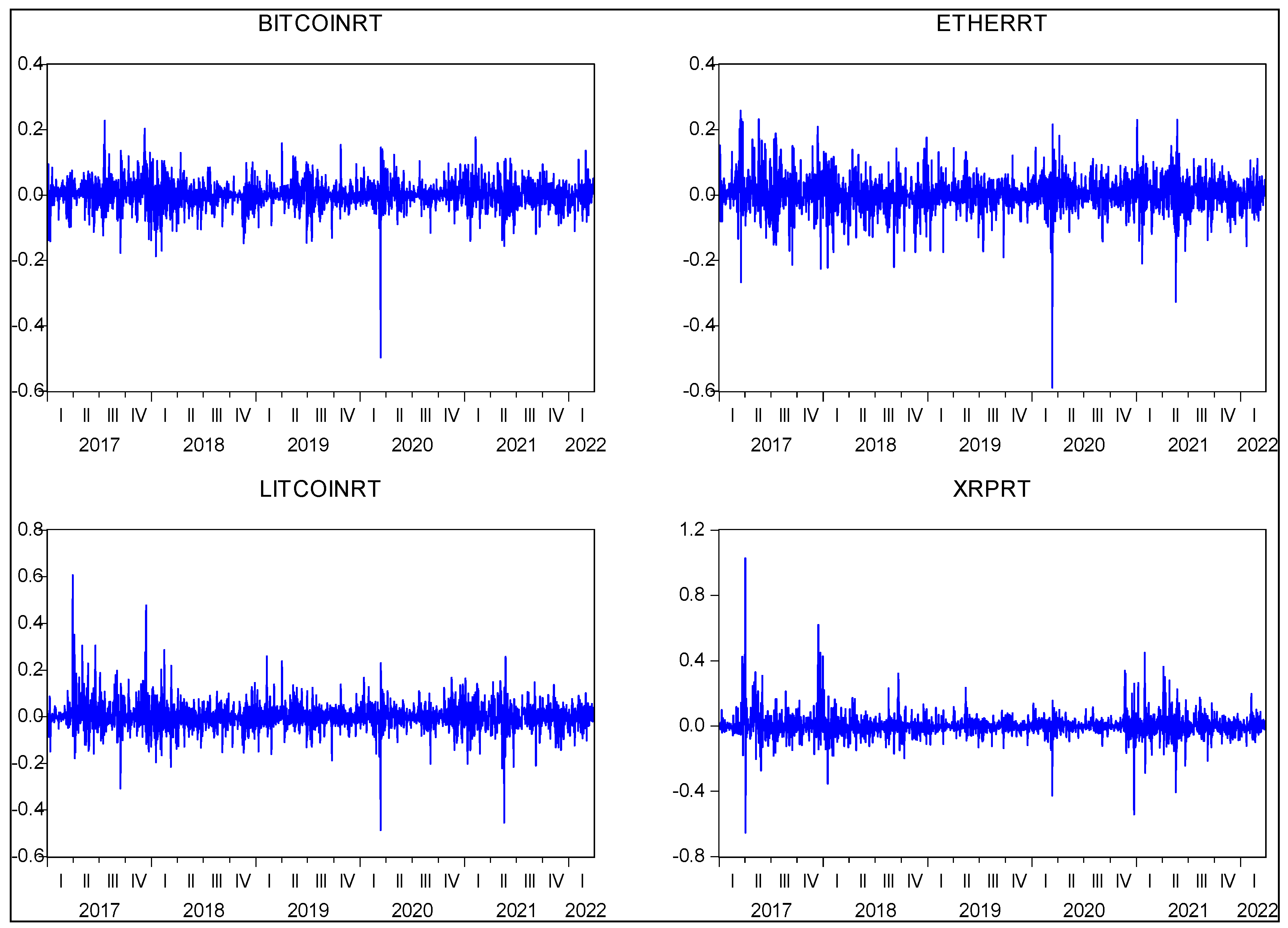

The crypto market volatility can be attributed to several key factors that significantly influence price fluctuations. One major cause is the speculative nature of cryptocurrencies. Investors often buy and sell based on market sentiment rather than underlying fundamentals, leading to rapid price changes. Furthermore, major announcements or events, such as regulatory updates or technological advancements, can create sudden spikes or drops in the market. For instance, when a country announces new regulations regarding crypto trading, it can lead to widespread panic or excitement, affecting market stability.

Another factor contributing to this volatility is the liquidity levels in the market. Unlike traditional financial markets, many cryptocurrencies have lower trading volumes, which means that even a small trade can lead to significant price movements. Additionally, factors such as market manipulation and the influence of large holders, often referred to as ‘whales,’ can exacerbate these fluctuations. Investors should also consider external influences like macroeconomic indicators and global market trends which can amplify the inherent volatility in the cryptocurrency market.

Counter-Strike is a popular first-person shooter game that emphasizes teamwork and strategy. Players engage in intense battles where they can take on the role of either terrorists or counter-terrorists, working to complete objectives or eliminate the opposing team. For those interested in the gaming community and betting, check out this cloudbet promo code to enhance your experience.

How to Strategize Your Investments in a Volatile Crypto Market

In an unpredictable landscape like the cryptocurrency market, it’s essential to strategize your investments effectively. Start by conducting thorough research into different cryptocurrencies, evaluating their technology, use cases, and market trends. This foundational knowledge will enable you to identify projects with strong fundamentals, which often perform better during downturns. Additionally, consider diversifying your portfolio to mitigate risk; only invest a small percentage of your total capital in any single asset. By spreading your investment across various cryptocurrencies, you can protect yourself from potential losses in a particular project.

Another crucial aspect of strategizing your investments in a volatile market is to establish clear entry and exit points. Use technical analysis tools to determine optimal times for buying and selling, and don’t forget to set stop-loss orders to minimize potential losses. It's also advisable to take a disciplined approach; avoid making impulsive decisions based on market emotions. Instead, stick to your investment plan and review it regularly to adjust to changing market conditions. The combination of a well-researched strategy and emotional discipline can significantly enhance your chances of success in the ever-fluctuating world of cryptocurrency.

Is the Rollercoaster Ride Worth It? Analyzing Risk vs. Reward in Digital Assets

The world of digital assets, including cryptocurrencies and NFTs, resembles a thrilling rollercoaster ride full of exhilarating highs and gut-wrenching lows. Investors are often faced with the dilemma of whether the potential rewards of investing in these volatile markets outweigh the inherent risks. With prices that can skyrocket in a matter of hours or plunge dramatically overnight, understanding risk vs. reward is crucial. Market volatility can be daunting, but for those willing to navigate the twists and turns, there may be opportunities for substantial gains.

To analyze the risk vs. reward dynamic effectively, consider the following factors:

- Market research: Stay informed about market trends and technological advancements.

- Diversification: Spread your investments across various digital assets to mitigate risks.

- Long-term vision: Focus on the long-term potential of digital assets rather than short-term fluctuations.